Drug shortages aren’t just inconveniences-they’re life-threatening. In 2022, the FDA recorded 245 drug shortages, and more than half of them involved sterile injectables used in hospitals during emergencies, surgeries, and cancer treatments. When a critical antibiotic or chemotherapy drug disappears from shelves, doctors scramble. Patients delay care. Some die. And the root cause isn’t bad luck-it’s a supply chain built for efficiency, not survival.

Why the Drug Supply Chain Broke

For decades, pharmaceutical companies chased lower costs. They moved manufacturing overseas, cut inventory to the bone, and relied on just-in-time delivery. It worked-until it didn’t. When the pandemic hit, borders closed, shipping lanes jammed, and factories in China and India shut down. Suddenly, the U.S. couldn’t get basic medicines like propofol, heparin, or vancomycin. Why? Because 72% of active pharmaceutical ingredients (APIs) used in American drugs come from just two countries: China and India. That’s not diversity-it’s dependency. The system wasn’t designed to handle shocks. It was designed to maximize profit. And when profit depends on cutting every possible cost, resilience gets sacrificed. The result? A fragile web where one broken supplier can trigger a cascade of shortages across dozens of life-saving drugs.What Resilience Actually Means

Resilience isn’t about having backup plans. It’s about building systems that don’t break in the first place. The National Academies of Sciences laid out a clear framework: resilience means being able to anticipate, prepare, respond, and recover without losing access to essential medicines. That sounds simple. But it requires real change. Not just emergency stockpiles or temporary fixes. It means redesigning how drugs are made, sourced, and tracked-from the raw chemical to the hospital syringe.Four Technical Pillars of a Resilient Supply Chain

There are four proven strategies that work together. Alone, none are enough. Together, they can cut shortages by 85%.- Buffer stockpiling: Keeping 6 to 12 months’ worth of critical drugs on hand. Not for every medicine-just the ones that can’t be replaced. Sterile injectables, antibiotics, anesthetics. This costs money, but not as much as treating patients who miss treatment.

- Supplier diversification: No single source for anything vital. If you make a drug using an API from China, you need at least two other suppliers in different regions-say, India and the U.S. The goal? At least three geographically separate sources for every high-risk product.

- Manufacturing redundancy: Dual-sourcing APIs for the top 80% of your usage volume. If you use 100 tons of an API a year, 80 of those tons should come from two different factories, not one. This isn’t luxury-it’s insurance.

- Substitution capacity: Having pre-approved alternative formulations ready. If Drug A is gone, can you switch to Drug B without retraining nurses or changing protocols? At least 15% of your formulary should include approved alternatives for critical drugs.

Costs vs. Consequences

Some say these fixes are too expensive. But the cost of doing nothing is higher. Reshoring all API production to the U.S. would raise prices by 25-40%. That’s steep. But you don’t need to bring everything home. A smarter approach: bring back only the most critical 10-15%-like insulin, epinephrine, and emergency antibiotics-and diversify the rest. This hybrid model, according to Duke-Margolis Center estimates, would cost $1.2-1.8 billion a year but prevent 85% of critical shortages. Compare that to stockpiling alone: $3.5-4.2 billion a year, preventing only 45% of shortages. Or worse-waiting for a shortage to happen, then scrambling. The 2023 ASPE analysis found drug shortages cost the U.S. healthcare system $216 million annually in extra expenses: emergency air freight, substitute drugs, extended hospital stays, overtime for staff. The real savings? Avoiding patient harm. No dollar amount can measure that.

Visibility Is Power

You can’t fix what you can’t see. And right now, most drugmakers are flying blind. Only 35% of pharmaceutical companies know where their suppliers’ suppliers are. Just 12% track raw material sources all the way back to the chemical plants. That’s like building a house without knowing where the bricks came from. Supply chain mapping technology is the missing link. Companies using AI-powered visibility tools report 32% fewer disruptions-even though they spend only 8% of their resilience budget on it. These tools track shipments, predict delays, flag geopolitical risks, and even detect cyber threats. And cyber threats are real. Between 2020 and 2023, attacks on healthcare supply chains jumped 214%. Hackers don’t just steal data-they shut down factories. In 2022, a ransomware attack halted production of a key chemotherapy drug for six weeks. That’s not a glitch. It’s a national security issue.Regulations Are Catching Up

The government is finally stepping in. The FDA’s 2023 draft guidance requires manufacturers to conduct annual vulnerability assessments. Full compliance is due by Q3 2025. That’s a start. But it’s not enough. The Drug Supply Chain Security Act (DSCSA) now demands full electronic tracing of every drug package by 2024. That means every pill, every vial, every injection will have a digital trail. It’s a massive technical lift-but it’s the only way to know where a drug is, when it was made, and who handled it. Even bigger: CMS’s 2024 proposed rule. If it passes, Medicare will tie reimbursement to supply chain transparency. Manufacturers will have to disclose their full supply chains by 2026. That’s a game-changer. It means if you hide your sourcing, you lose funding.Who’s Doing It Right?

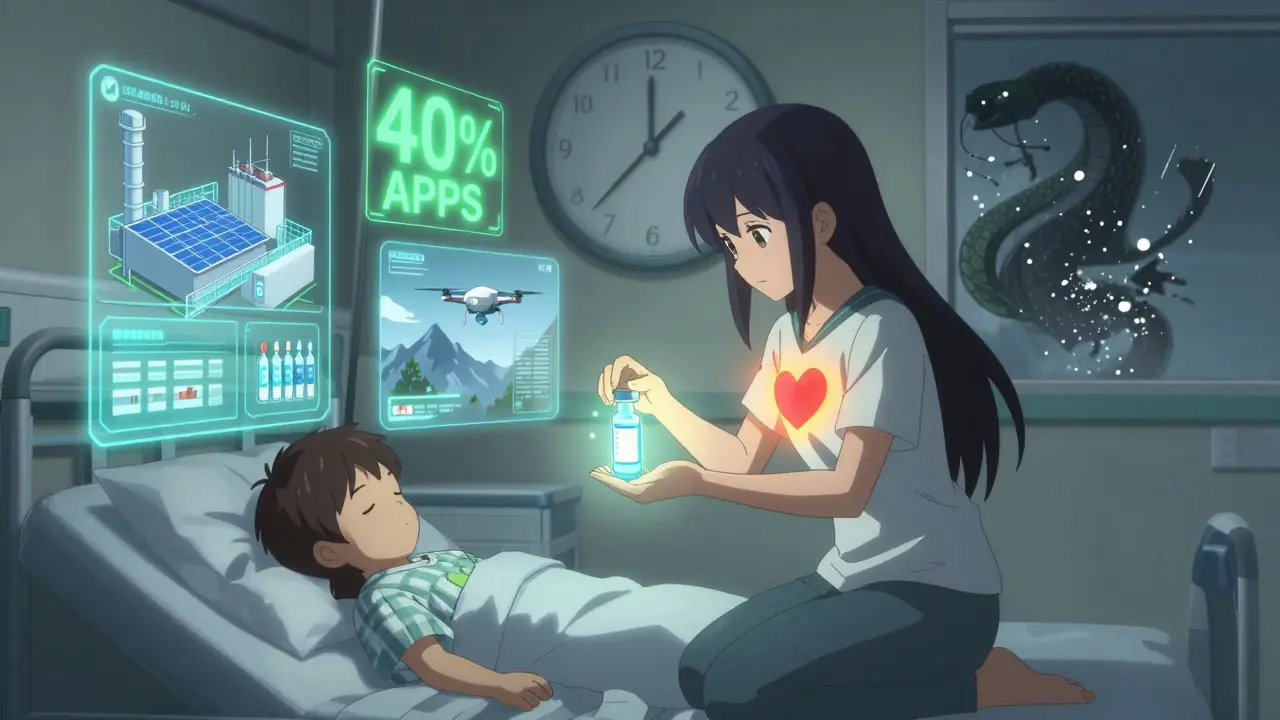

Pfizer spent $220 million and 18 months building an AI-driven forecasting system across 150 distribution centers. Result? A 38% drop in stockouts. Merck used $85 million in federal incentives to rebuild domestic production for 12 critical antibiotics. Now, 95% of those APIs come from U.S. soil. Yes, costs went up 31%. But they didn’t lose a single dose during the pandemic. Distributors in rural states are testing drone deliveries to pharmacies. Emergency deliveries that used to take three days now arrive in four hours. Regulatory hurdles? Still a mess. But the tech works. These aren’t outliers. They’re blueprints.

The Biggest Barrier Isn’t Tech-It’s Incentives

The hardest part isn’t building the systems. It’s getting companies to pay for them. Procurement departments still choose suppliers based on the lowest bid. Resilience doesn’t show up on a spreadsheet. Stockpiles look like waste. Redundancy looks like inefficiency. Diversification looks like extra cost. But here’s the truth: if you wait until a drug vanishes to act, you’re already too late. The solution? Change how drugs are paid for. Tie reimbursement to resilience. Reward companies that diversify. Penalize those who hide their supply chains. Make it cheaper to be safe than to be sorry.What Comes Next

By 2027, the HHS plans to have 40% of APIs for 50 critical drugs made in the U.S. That’s progress. But it’s only a start. We need 125,000 new supply chain risk specialists by 2027. Right now, only 35% of companies have staff trained to analyze supply chain risks. Training programs are lagging. Universities aren’t teaching this. The industry is falling behind. And we need better data. Right now, critical drug lists are based on clinical use-not on supply risk. Only 28% of those lists even consider whether a drug is hard to source. That’s like ranking fire extinguishers by color instead of effectiveness.It’s Not About Politics. It’s About Survival.

This isn’t about nationalism or trade wars. It’s about making sure a mother can get her child’s antibiotics. A cancer patient can get their chemo. A heart attack victim can get epinephrine. The tools exist. The data is there. The models are proven. What’s missing is the will to invest-not in the next quarter’s profits, but in the next decade’s safety. Resilience isn’t a cost center. It’s a lifeline.What causes most drug shortages?

Most drug shortages stem from manufacturing disruptions, especially when a single facility produces a critical active pharmaceutical ingredient (API) and something goes wrong-whether it’s a quality control failure, natural disaster, geopolitical issue, or cyberattack. Geographic concentration, particularly in China and India, makes the system vulnerable. Just-in-time inventory practices leave no buffer, so even a minor delay can trigger a nationwide shortage.

Can stockpiling alone solve drug shortages?

No. Stockpiling helps, but it’s expensive and limited. Keeping 6-12 months of inventory for all critical drugs would cost $3.5-4.2 billion annually and only prevent about 45% of shortages. It doesn’t fix broken manufacturing or supply chain gaps. True resilience requires combining stockpiling with supplier diversification, manufacturing redundancy, and better visibility across the chain.

Why not just make all drugs in the U.S.?

Reshoring everything would raise drug prices by 25-40%, making many medicines unaffordable. The smarter approach is to bring back only the most critical drugs-like emergency injectables and antibiotics-while diversifying sourcing for others. This hybrid model prevents 85% of shortages at a fraction of the cost of full reshoring.

How does cybersecurity affect drug supply chains?

Cyberattacks are now a top threat. Between 2020 and 2023, attacks on healthcare supply chains rose 214%. Hackers have shut down drug factories, stolen production data, and disrupted shipments. Without NIST cybersecurity standards across all suppliers, a single breach can halt production of life-saving medicines. Resilience now includes digital security as a core pillar.

What’s being done by the government right now?

The FDA now requires annual supply chain vulnerability assessments by 2025. The DSCSA mandates full electronic tracking of all drugs by 2024. The HHS has allocated $520 million to boost domestic production of 50 critical medicines by 2027. CMS is also proposing to link Medicare payments to supply chain transparency, forcing manufacturers to disclose their sourcing by 2026.

Will these changes make drugs more expensive?

Some will, but not because of the resilience measures themselves. The bigger cost driver is the current system’s failure-drug shortages cost $216 million a year in emergency responses, extended hospital stays, and substitute drugs. Investing in resilience now reduces long-term costs and prevents human harm. The goal isn’t to raise prices-it’s to stop paying a hidden, far higher price later.

Kevin Narvaes

lol so we just need to print more money and call it 'resilience'?? 🤡

Philip Williams

The structural vulnerabilities outlined in this post are not merely logistical-they are systemic failures of prioritization. We have optimized for quarterly returns at the expense of national health security. This is not a supply chain issue; it is a moral one.

Rod Wheatley

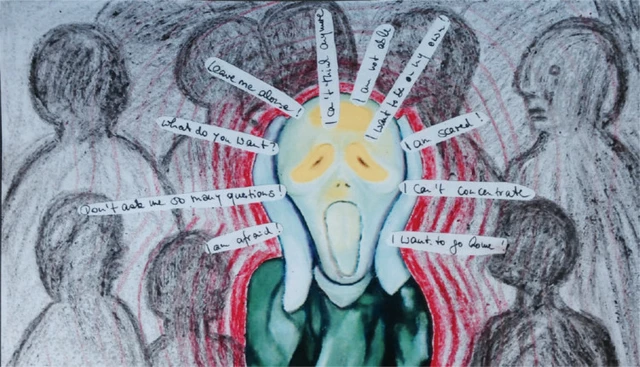

I've worked in hospital pharmacy for 18 years... and I can tell you, this isn't theoretical. I've watched nurses cry because they couldn't get epinephrine for a code blue. We need buffer stocks-yes. But we also need to stop treating APIs like commodities. They're not widgets-they're lifelines. And if we don't fix this, someone's kid is going to die because a factory in Goa had a power outage. And it won't be a surprise. We saw this coming.

Jarrod Flesch

This is so real 😔 I'm from Australia and we've had the same issues with insulin and chemo drugs. The drone deliveries in rural US? Genius. Why aren't we doing this everywhere? 🚁💊

Stephen Rock

Resilience? More like socialism for Big Pharma. Let the market fix it. If you need a drug and it's gone... tough luck.

michelle Brownsea

This is what happens when you let greedy corporations run everything. They didn't just cut corners-they dismantled the entire safety net. And now they want us to pay more to fix it? No. They should be fined. Held accountable. Forced to rebuild. This isn't innovation-it's negligence. And it's criminal.

Roisin Kelly

They're lying. This is all a scam to get more government money. The FDA and Big Pharma are in bed together. You think they actually care if you die? They just want you to panic so they can sell you overpriced 'resilience solutions'. Wake up.

lokesh prasanth

India makes 70% of global generics. Why blame us? You outsource then cry when it breaks. Fix your own system.

Malvina Tomja

You're romanticizing bureaucracy. Supply chain mapping? AI tools? These are expensive toys for Fortune 500 companies. Most manufacturers can't afford them. And now you want to penalize them? You're not fixing anything-you're just making it harder for small players to survive.

Samuel Mendoza

The real problem? You think we need 3 suppliers. We need zero. Just let people buy drugs from anywhere. Free market. No regulations. Problem solved.

Glenda Marínez Granados

So we're gonna spend $1.8B to avoid a $216M problem? ...I guess that's how math works when you're emotionally invested in not dying. 🤷♀️

Yuri Hyuga

This is one of the clearest, most urgent public health arguments I've read in years. The four pillars are not just logical-they're ethical. We are not investing in infrastructure. We are investing in human dignity. Thank you for laying this out with such clarity. Let's not wait for another tragedy to act.

MAHENDRA MEGHWAL

The proposed regulatory framework is commendable, yet its implementation requires standardized interoperability protocols across global supply nodes, which remain unaddressed in current policy drafts. Without harmonized data exchange standards, traceability systems will remain siloed and inefficient.